Is Amazon destroying your finances? You might be surprised to learn how the money you’re spending with the online behemoth could be invested for a much bigger return in the long run.

Amazon has become a mainstay for Canadian families when it comes to household shopping. Running out of diapers or need more garbage bags? They’re only a click away and can be on your doorstep in as little as a few hours.

In fact, these benefits are so effective at getting people to part with their cash that the experience for many shoppers 'is almost like a drug.’

Small purchases leave a big dent

And this addictive behaviour is causing many of us to lose track of our spending habits, wreaking havoc on our budgets. Obviously, diapers and garbage bags are considered necessities. But that’s not all we’re buying from Amazon.

Many of us don’t realize that a few little items here and there really add up.

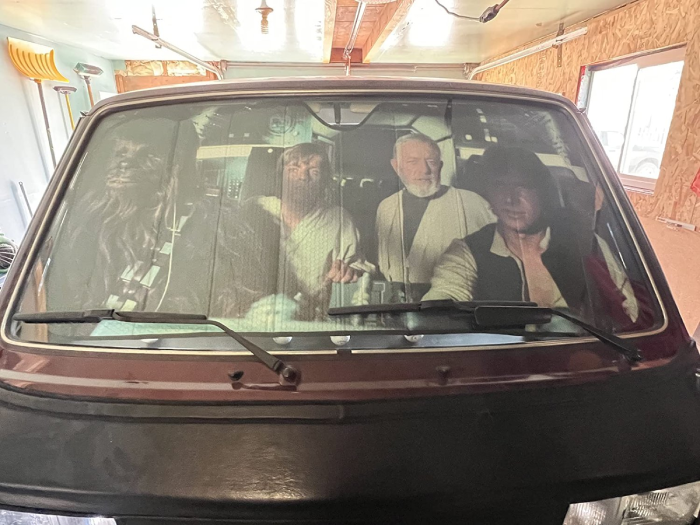

For example, check out this sunshade for your car or van that looks like the cockpit of the Millennium Falcon!

What a steal at just $45!

Image credit: Jason Butler from amazon.ca

Rinse and repeat and all of sudden you’ve spent $300 on things you could really live without.

OK, well, maybe not the sunshade. That’s definitely a necessity.

Buying more than we need

This phenomenon actually started years ago with Costco. You would go into the store to buy some toilet paper and toothpaste and end up pushing out two carts with a 3-foot receipt for $400 of stuff you truly have very little use for.

Did you really need a 12-pack of romaine lettuce and a 4-year supply of printer paper? Amazon has only made those impulse purchases that much easier. You don’t even need to leave the house to buy crap you don’t need; they will deliver it right to your door - at the click of a button.

A prime target for overspending

If you’re a Prime member, things could be even worse. A survey from 2019 found that Prime members spend an average of $1,400 on the online shopping platform every year, compared to $600 for non-Prime members.

And this study was conducted pre-COVID. Amazon’s Q1 profits in 2021 were up 220% compared to the previous year, which means we were all seeing a lot more Amazon packages on our doorstep during lockdown.

Run an Amazon audit

So how can we curb this out-of-control online spending? Some banking apps help track your expenditures, but they aren’t really able to tell you what was an essential expense from Amazon and what was a frivolous purchase.

The best course of action is to audit your recent purchases by looking back through the last 3-6 months of your Amazon order history and identify what was something you needed and what was something you wanted.

Figure out how much you are spending on the latter and decide whether you would be better served to put that money to save for your retirement or pay down your mortgage. Better yet, if you have children, start a Registered Education Savings Plan (RESP) and take advantage of a 20% grant from the government – you could get up to $500/year for free for your children’s education.

We did the math

Let’s put this into context. If you were to save the $300/month by abstaining from these impulse purchases and, instead, invested the cash in your TFSA, you would have over $20,000 saved over a 5-year period (assuming a 5% rate of return). That’s enough for a used vehicle or a month-long trip to Europe! Would you rather have some reliable wheels or memories to last a lifetime - or a taco toaster?

If you really want to punish yourself, you can also audit your spending on Uber Eats and Grubhub – but one step at a time.

Want to get a handle on your budget or need to set up some financial goals (like opening an education savings plan for your little [or big] one)? Get in touch today to set up a free financial consultation.